nsave↗

Intro

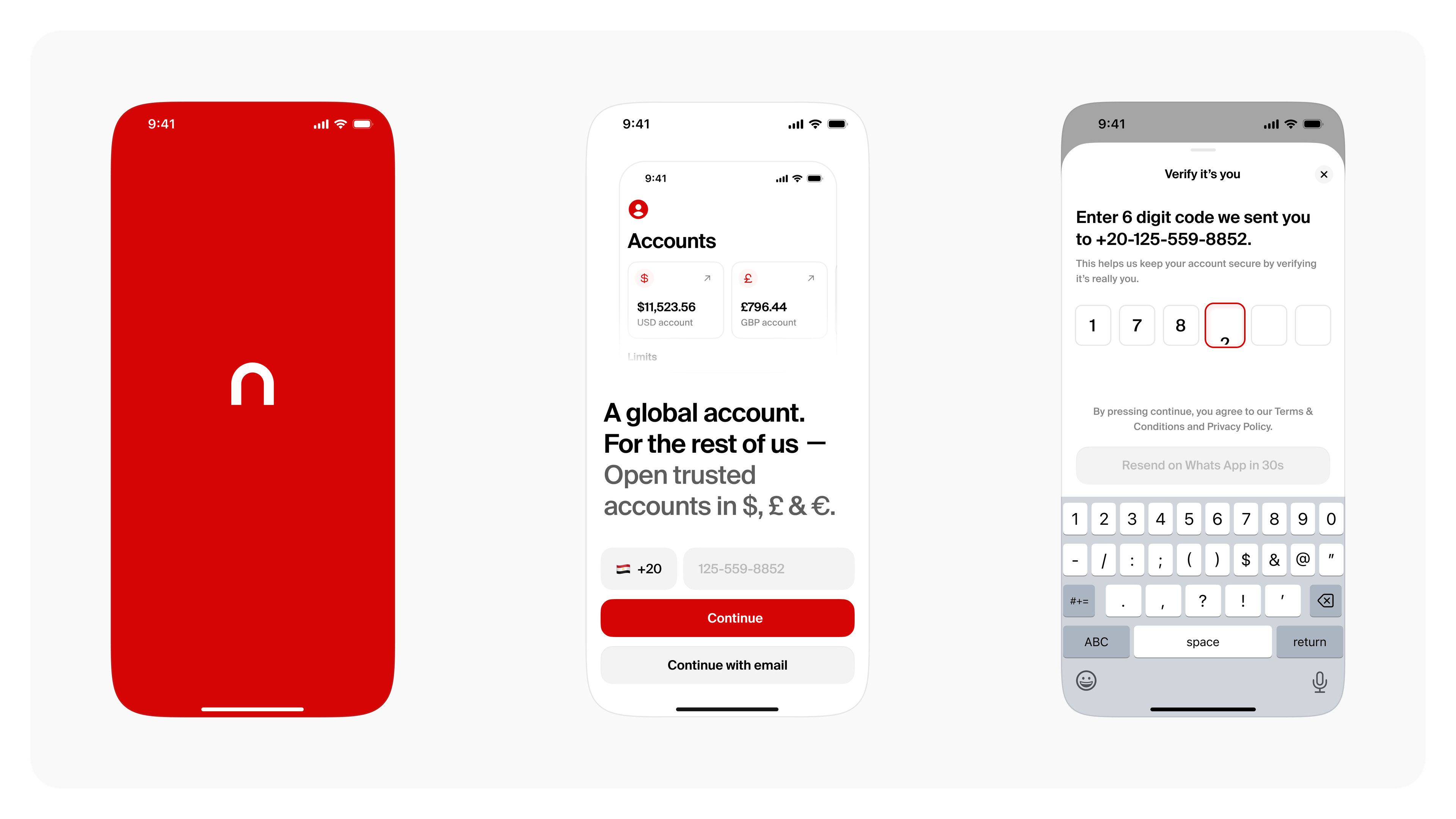

nsave is a cross border fintech platform for emerging markets that brings savings, investments, and everyday banking into one simple, intuitive experience. Designed for transparency, accessibility, and financial literacy, it helps people in underbanked and high inflation regions securely manage, grow, and move their money.

I led the design from concept to launch, ensuring every detail addressed user needs while meeting strict regulatory requirements.

Problem

Users in high-inflation countries struggle with traditional banking systems that lack transparency, charge hidden fees, and provide poor user experiences for international transfers and investments. The existing solutions are often complex, expensive, and don't address the specific needs of these markets.

Role & Team

Owned the design vision and execution from concept to launch, working closely with engineering, product, and growth teams to deliver features that met user needs, complied with regulations, and supported business growth. Led every stage from research and ideation to prototyping, testing, and final delivery to create a cohesive, high-impact experience.

Approach

Spoke directly with users, studied competitors, and reviewed local regulations to understand needs across our target markets. The research showed a clear demand for transparency, simplicity, and better financial literacy tools.

Created detailed PRDs for every feature to ensure alignment between design, engineering, and business from day one. This gave everyone a shared understanding of scope, priorities, and success criteria.

Worked closely with engineering to explore technical possibilities and limitations. Partnered with the growth team to plan rollouts, define test strategies, and ensure features could scale effectively.

Prototyped and tested multiple design directions, collecting feedback from users and internal teams. Refined the product until it struck the right balance of business goals, logic, and usability.

Delivered a clean, minimalist interface focused on clarity and intuitive navigation, even for complex financial operations. Integrated real-time data updates and transparent fee calculators to build trust with users.

Launched flows that felt lightweight and approachable while simplifying high-stakes financial tasks. The result was a product that met business needs and gave users confidence in every interaction.

Challenges

Designing a cross border financial product that complies with multiple regulatory frameworks while remaining easy to use for everyday transactions.

Simplifying investments, savings, and cross border money transfers for users in underbanked regions, many of whom are new to digital finance.

Creating a platform that works seamlessly across different currencies, payout systems, and local market conditions without sacrificing speed or reliability.

Building credibility and user confidence in regions where financial instability and lack of secure banking options are common.

Solution

Created a financial platform that is simple, transparent, and built for global use. The main screen shows a unified account balance that includes savings, investments, available funds, and interest earned.

Users can seamlessly send and receive money, cash out to local merchants, invest in stocks, ETFs, bonds, and precious metals, and manage multi-currency accounts in USD, GBP, and EUR.

The platform also offers both virtual and physical cards for global spending. The result is a product that meets regulatory requirements, drives business growth, and gives users clarity, control, and confidence in managing their finances.

Impact

Successfully launched a cross-border financial platform that serves users across multiple emerging markets, providing them with transparent, accessible banking services.

The platform has helped users in high-inflation countries better manage their finances, with features that address their specific needs for international transfers and investments.

Reflection

Working on nsave deepened my understanding of the financial challenges in emerging markets and how industry constraints shape product decisions. I learned to design experiences that build trust while accommodating strict compliance and varied user behaviours. It reinforced the importance of simplifying complex financial actions without losing functionality.